Governing Inside and Out

Complexity is a phenomenon of our economy and society. Complex interactions mean that cause and effect are uncertain, sometimes separated through time and space.

Meta-risks are the qualitative implicit risks that pass beyond the scope of explicit financial risks. Most are born from complex interactions between the behaviour patterns of individuals and organisational structures.

Jack Gray; The Treasurer, page58 June 2002

Complexity ensures we humans will make mistakes.

When mistakes are made the consequence can be dire, even fatal. Progress however demands that we get up and dust ourselves off to try again. This approach while necessary is not sufficient for progress.

The history of human development shows us that certain sectors of society progress while others become trapped – like a leaf in an eddy – there is movement but it’s not going anywhere.

If we look at medicine we can see quantum improvements in understanding of what we need to overcome illness and broken bodies. It wasn’t always like this with medicine. Much of medicine was stuck in a closed loop of blood letting and arsenic cures for about 400 years.

A scientific worldview was established in medicine – to test ideas to failure and find out why the idea was or was not worthwhile. This allowed us to learn, in a virtuous cycle of discovery of breakthroughs or dead ends.

However it was not just the creation of the scientific method that meant society benefited. Remember that Galileo was forced to spend the last eight years of his life under house arrest because of his science. There had to be a shift of mind set (worldview) within the governing cohort of the times to allow a scientific worldview to prosper and benefit society.

The prevailing mind set (worldview) in your organisation will determine the type of risk you are prepared to work with. A key element of your worldview will be your shared assumptions about success and failure.

In David McClelland’s famous work on Motivation Theory he initially identified three core needs; he added the 4th – Avoidance – later.

Avoidance and blame are responses to a fear of failure, are deeply embedded in our organisations and undermine our capability for work with complexity.

Here are two perspectives on fear of failure.

- The first is interpersonal, how we relate with others. The story we tell our selves about how others will judge us.

- The second is intra-personal, our self-image, who we are, why we do what we do, how we make meaning and create our identity.

So how does it work?

First we must avoid blame from others and the punishments that go with that.

Second we must never admit to ourselves that we have failed. Our Ego works very hard to help us avoid and rationalise anything that might challenge our association with success and the rightness of our actions.

We are all exposed to the quintessentially human meta-risk of hubris. We all risk acting like “masters of the universe”,…

Jack Gray , The Treasurer

The flip side of an un-discussable fear of failure is a narrative of infallibility. The “smartest person in the room” syndrome has been written about, studied and validated over decades of corporate failures built on the edifice of super confident, self-believing chief executives and directors of boards for whom failure was not an option.

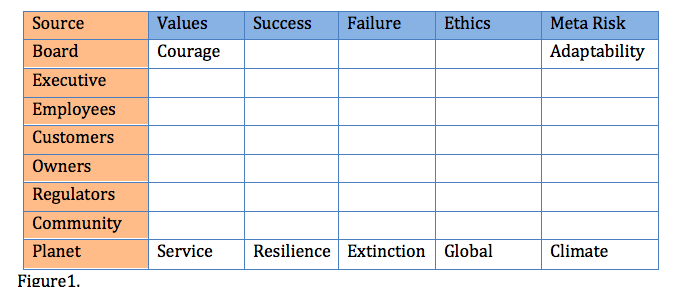

Your values and attitude to failure can be productively surfaced and will help to create a governing practice that will support adaptation as you innovate with complexity not in spite of it.

Surfacing Key Shared Assumptions

These are some starter questions for your self and your governing cohort.

What is our definition of Success? What is our definition of Failure?

What are our customers, stakeholders, employees, community’s definition of success and failure with regard to our organisation?

BRAKTEN CONSULTING will help you create a dialogue for insight and action and build your own ethical framework. The clarification of your values and attitude to failure is the foundation of your Mind set (Worldview).